Can Legal Heirs Challenge a Gift Deed?

Date : 25 Jan, 2025

Post By admin

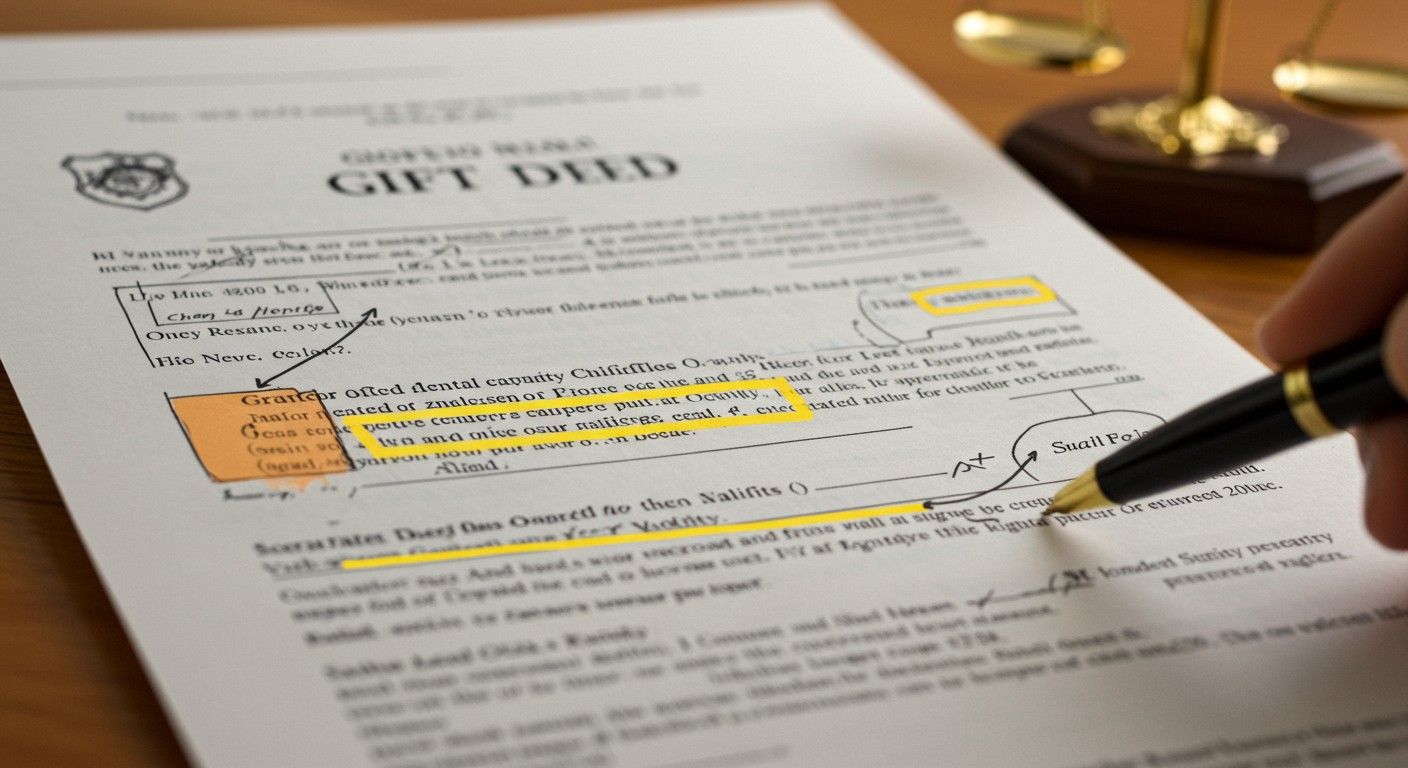

Legal heirs in India can challenge a gift deed if it was executed under questionable circumstances. Grounds for contesting include lack of free consent, undue influence, fraud, and mental incapacity of the donor at the time of execution. If legal formalities were not followed during the creation or registration of the gift deed, heirs can seek to invalidate it. Understanding these rights is essential for those who feel aggrieved by an unjust property transfer, as timely action and evidence are crucial in navigating this legal field.

Defining the Legal Framework and Requirements.

A gift deed operates within a legal structure defined by the Transfer of Property Act, 1882, and the Registration Act, 1908. For a gift to be valid, it must meet specific criteria: it must involve voluntary transfer without consideration, acceptance by the donee during the donor's lifetime is essential, and registration with a sub-registrar for immovable properties is mandatory. Failure to adhere to these stipulations can render the deed void and subject to challenge in court. Legal heirs who believe due process was not followed have grounds to contest such deeds based on non-compliance with regulations.

Lawtendo provides valuable insights into navigating challenges associated with gift deeds. Its platform connects individuals with experienced legal professionals who specialize in inheritance law and property disputes. By leveraging Lawtendo's services, potential challengers gain access to expert advice tailored to their situation—ensuring they understand their rights under Indian law and the necessary steps for pursuing claims related to contested gifts efficiently within prescribed time limits.

Exploring Valid Reasons to Contest a Gift Deed.

Identifying Eligible Individuals for Challenges.

- Establishing Eligibility: Legal heirs must confirm their standing based on inheritance laws.

- Eligible Challengers: Includes direct descendants (children, siblings) and distant relatives under intestate succession laws.

- Valid Grounds for Challenge:

- Coercion – If the donor was pressured into signing.

- Fraud – If the deed was obtained through deception.

- Mental Incapacity – If the donor lacked sound judgment at the time of signing.

- Understanding Inheritance Rights: Essential for pursuing a legal challenge.

Overview of Judicial Precedents on Challenges.

Judicial precedents shape challenges to gift deeds as courts interpret statutory requirements in laws like the Transfer of Property Act. In landmark cases, judges have emphasized the need for clear evidence that procedural norms were followed during execution; failure to comply can lead to invalidation. The Supreme Court has stated that without free consent or due process, any purported transfer may be deemed incomplete—these rulings highlight the importance for legal heirs seeking redress to understand both historical interpretations and current judicial attitudes.

Understanding the Statutory Limitation Period.

Legal heirs must be mindful of the statutory limitation period when challenging a gift deed, as this timeframe is crucial for ensuring their claims are heard in court. Under the Limitation Act of 1963, they typically have three years from the date of execution or when they became aware of any fraudulent circumstances to contest the deed. This time constraint emphasizes the importance of prompt action; delays can jeopardize their ability to seek legal remedies and protect their inheritance rights.

Steps to Initiate a Legal Challenge.

Importance of Hiring Experienced Legal Advisors.

Hiring experienced legal advisors is crucial for challenging a gift deed. Legal counsel provides an understanding of inheritance laws and statutory requirements, ensuring heirs can effectively articulate their claims based on grounds like undue influence or lack of consent. This expertise enhances representation quality and increases the likelihood of favorable court outcomes.

How Lawtendo Assists in Legal Matters.

-

Access to Knowledgeable Attorneys – Connects individuals with skilled legal professionals specializing in inheritance law.

-

Understanding Legal Rights – Provides insights into users' specific situations, ensuring clarity on rights under Indian law.

-

Direct Consultations & Personalized Advice – Facilitates expert legal guidance tailored to individual cases for informed decision-making.

-

Streamlining the Legal Process – Simplifies the steps involved in contesting a gift deed, making the process more efficient.

-

Guidance on Procedural Requirements – Assists in meeting legal formalities and filing documentation correctly.

-

Support in Evidence Gathering – Helps challengers compile necessary proof to strengthen their case in court.

-

Clarity on Statutory Limitations – Ensures clients understand legal timeframes and requirements for challenging a gift deed.

-

Confidence & Empowerment – Provides continuous support, ensuring legal heirs feel equipped to pursue rightful claims against unjust property transfers.

Summarizing the Rights of Legal Heirs.

Legal heirs in India have specific rights to challenge a gift deed if they believe the transfer was executed under questionable circumstances. Grounds for contesting include lack of free consent, undue influence, fraud, and mental incapacity of the donor at the time of execution. Heirs can also challenge a gift deed on procedural grounds if legal requirements were not met during its creation or registration. Understanding these rights is crucial for direct descendants and other potential claimants who feel aggrieved by an unjust property transfer.

FAQ

What are the legal grounds on which a gift deed can be challenged by legal heirs?

Legal heirs can challenge a gift deed on grounds like lack of consent, undue influence, fraud, mental incapacity, non-compliance with legal requirements, violation of conditions, and revocation rights.

Who is eligible to contest a gift deed in India?

Legal heirs, including direct heirs like children and collateral relatives like siblings, can contest a gift deed in India if they believe their inheritance rights have been infringed.

What is the time limit for filing a challenge against a gift deed?

The time limit for filing a challenge against a gift deed is three years from the date of execution or when fraud or coercion is discovered.

What steps should be taken to initiate a challenge to a gift deed in court?

To challenge a gift deed in court, an individual files a suit for declaration in the civil court, presents evidence to support their claims, and engages legal counsel for guidance.

How does Lawtendo assist individuals dealing with challenges related to gift deeds?

Lawtendo assists individuals facing challenges related to gift deeds by providing legal guidance, ensuring compliance with requirements, and helping clients navigate property law to minimize disputes.