Rahul Tope

Thank you Lawtendo for helping me in the registration process of my company

The real meaning of “Nidhi” in Hindi is a treasure. The word Nidhi is also used to name girls in Ahmednagar which means the girl possesses a treasure of knowledge and wealth. In legal terms, there is no definition of Nidhi so we adopt this meaning. These companies are predominant in southern parts of India.Section 406 of the Companies Act, 2013 deals with the process of registration of Nidhi Companies. Nidhi Company refers to a type of NBFC(Non-Banking Financial Corporation) which is governed and regulated by the provisions of the Companies Act, 2013.” NIDHI” stands for National Initiative for Developing and Harnessing Innovations. The prime reason for incorporating this company is to encourage and motivate its members to save and satisfy their basic needs from time to time. This company is based on the principle of Mutual Benefits. The only significant feature that differentiates this company from other companies is that this business structure deals with the deposits from and loans to its members i.e shareholders only and works for its member’s mutual benefits. Benefits of a Nidhi Company Registration: No external involvement in the company’s management Low capital requirement Relaxation in the number of compliances Cost-efficient registration Secured investment with a lower rate of interest Better savings option It has a separate legal entity Simple processing There are various privileges and exemptions provided under the provisions of the Companies Act, 2013 Limited liability Easy access to public funds No compliance with RBI Low level of risk Basic requirements for incorporation of Nidhi Company: Members required: A minimum of 7 Shareholders or Members. Directors: A minimum of 3 Directors required. Capital: A minimum of Rs. 5 Lakhs needed as a capital requirement. DIN(Director Identification Number) for Directors. No Preference Shares will be issued. The main objective of this company is to inculcate the habit of saving in its members or shareholders by receiving deposits from and lending to them only for their mutual benefits. The nominal value of each equity share: should not be less than Rs. 10 per share. Shares to be given to each deposit holder: A minimum of 10 equity shares or shares of Rs. 100 should be given to each deposit holder. The name of the company must always contain “ Nidhi Ltd”. Any company that wants to register for Nidhi Company must have a minimum of Rs. 10 Lakhs as Net Owned Funds. This is necessary for registration and must be followed. Is Nidhi Company allowed to have branches? Yes, a Nidhi Company is allowed to have branches but subject to some conditions. They are as follows: There should be profits earned by the company continuously for the preceding three financial years. This business structure is permitted to open up to three branches only. It should be taken into consideration that all these branches must have opened within the same district. If in case it wants to set up more than three branches, it needs to seek and acquire permission from the Regional Director (RD). These branches can be opened either within territorial limits in the same district or a separate district. The Registrar of Companies (ROC) must be informed about the opening of branches within 30 days. Loan and Deposit under Nidhi Company: Nidhi company has become popular among businessmen who want to start finance or loan business. The main reason behind this is the advantage of Nidhi Company to accept deposits from the public and lend money to the public (Members) without any RBI approval. Loan under Nidhi Company: It can lend three types of loans i.e gold loan, property loan, and others such as LIC, FD, etc. It cannot engage in microfinance business but can lend secured loan @20% interest. It can take legal action against any member if they fail to repay any sum of money. Deposits under Nidhi Company: It can accept three types of deposits i.e Fixed Deposit (FD), Recurring Deposit (RD), and savings. It can pay interest up to 12.5% on FD and RD and 6% on savings accounts. It can make deposits up to 20 times the funds invested. Invest 5 lakh and accept 1 crore. Nidhi Company Software: India’s No 1 Nidhi Company Software with a mix of amazing blend of modern technology with a fine grift of technical knowledge. This software is only made to generate and manage share transfer for Nidhi Companies in Ahmednagar.The original price of the software is Rs. 60,000/- but promotional price is Rs. 35,400/- (All Inclusive) Event-Based Compliances of the Nidhi Company: These compliances are to be filed only at the time of the registration of the Nidhi Company. Such compliances denote any changes in the company which are to be done .They are not required to file repeatedly. Any changes required to be made in the name of the company Any changes required to be made in the registered office address of the company Change in the objects of the company Change in the capital structure of the company eg. Increase in authorised capital of the company Appointment of Director and Auditor Resignation of Director and Auditor Transfer of shares Penalties for Non- Compliances: Legal window highly recommends timely filing of compliances as they are compulsory. Any non-compliance will attract penalties and the companies and the officers will be fined up to an amount of Rs. 5000. In case the violation continues, a further fine of Rs. 500 everyday will be applicable on the company. You can contact Legal Window to help in the procedure related to compliances. Nidhi Company Rules,2014: Nidhi Companies are governed by the Central Government through Nidhi Rules,2014. Nidhi Rules have laid down some rules according to which every Nidhi Company should work. Nidhi Company does not require any other approval from any state authority to work as it is permitted by Central Government in terms of Nidhi Rules, 2014. Nidhi Company Rules, 2014 contain almost 24 rules describing the loan, deposits, Compliances, branches etc. about the Nidhi Company. Top Nidhi Companies in Ahmednagar: Malabar Nidhi Limited (Thrissur, Kerala) Shivneri Mutual Benefit Nidhi Limited (Pune, Maharashtra) Shree Jeevan Nidhi Limited (Udaipur, RJ) Mountsoft Mutual Benefit India Nidhi Limited (Mathura, UP) Maben Nidhi Limited (Thrissur, KL)

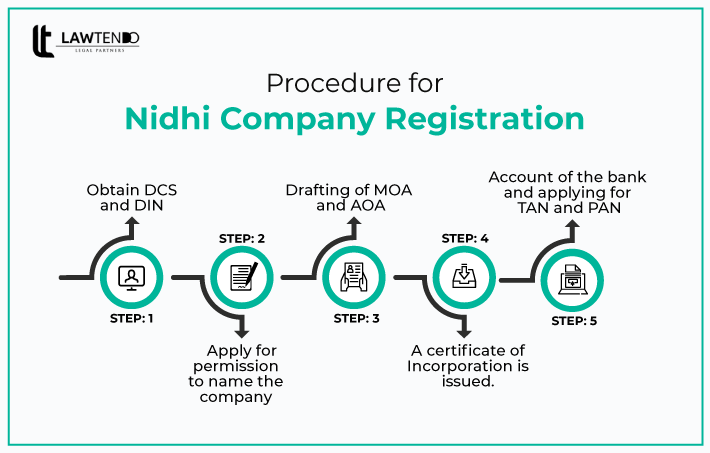

The partners of a Nidhi company need to apply for the Director’s Identification Number (DIN) and Digital Signature Certificate (DSC). DIN is issued by the MCA and DSC is an online signature used in all e-filing processes. This step is not needed if a director already owns DIN and DSC.

You are required to suggest 3 different names to MCA for Nidhi Company Incorporation. Out of those 3 names, one will be accepted by MCA. The suggested names must be unique and must not match the other registered businesses’ names.

Once the name has been approved, you need to prepare MOA and AOA. These must mention the main objective of incorporating a Nidhi company and it must be a charity. Both the documents are filed to the MCA including the subscription statement.

The time to form a Nidhi company and get the incorporation certificate is usually 15-25 days. It certifies that a company has been formed and it includes the company identification number (CIN) too.

You are required to apply for PAN and TAN. Afterward, you can get a bank account opened by submitting the Certificate of Incorporation, MOA, AOA, and PAN in the bank.

It takes around 30-40 days for the completion of the registration process.

Proof of the registered place of business

No Objection Certificate (signed by the owner/ landlord)

Identity proofs

Address proofs of the members

Photos of the members

PAN card copies of the members

Digital Signature

Director Identification Number of the directors

Memorandum of Association of the company

Articles of Association of the company

Click here to know about Nidhi Company Registration Online In Aizawl