BOOK A SERVICE

ONE PERSON COMPANY REGISTRATION SERVICES OVERVIEW IN AURANGABAD

The introduction of “One Person Company” in the Companies Bill 2013, got its assent first in Lok Sabha on 18 December 2012 and then in Rajya Sabha on 29 August 2013. This finally led to the making of the Companies Act, 2013. This Act is made to support entrepreneurs who are capable and want to start their own business single-handedly. The biggest advantage of a one-person company is there can only be one member. For incorporating and maintaining Private Ltd Company and Limited Liability Partnership( LLP), a minimum of two members are required. One Person Company is a separate legal entity different from its promoters and also it is very easy to incorporate. One Person Company must nominate a nominee Director in the MOA and AOA of the Company who will become the owner of the company and continue with the operations of the company in the event of death or incapacity to run the contracts of the member. The MOA shall contain the name of the nominee and prior written consent shall be taken before the appointment of a nominee. The nominee can also withdraw his consent by giving notice so that the sole member can appoint another nominee within 15 days of receipt of such notice. One Person Company is not permitted to carry on non-banking financial activities such as investments in securities of other companies and it also cannot work as a Non-Profit Organisation (NPO). Eligibility: That person should be a natural person ( i.e Indian and resident of India) That person cannot be a member of any other One Person Company That person cannot be a nominee for more than one One Person Company That member or nominee cannot be a minor Benefits of incorporating One Person Company: Separate legal existence: One Person Company enjoys a separate legal entity irrespective of its promoters. It says that a separate legal entity has a separate identity and has certain rights and obligations as that of persons i.e right to sue or be sued, able to enter into contracts, and own its own property. In the eyes of law, a company is a person and it has its own common seal and perpetual succession. Limited liability: The liability of One Person Company limited to the extent of shares held by an individual. This means that an individual has to take more risks in business. Here if there is a loss in business then the personal assets of the individual are not affected. Easy funding: It can raise funds through venture capital, financial institutions, or angel funding. It can also raise funds by converting into a private limited company. It is very easy to raise funds from various options. Tax benefits: A contract can be made with shareholders and directors. This means that as a director you can receive remuneration, as a lessor you can receive rent, as a creditor you can advance money to your own company and can earn interest. Such rent, director’s remuneration, and interest are deductible expenses that reduce the profitability of the company. Benefits of being a small scale industry: One Person Company has to pay a lower rate of interest on loans and also easy funding is available from banks without a security deposit. All these benefits help to establish a business in the initial years of business. Compliance requirements: The compliance requirements of One Person Company are lesser as compared to a private limited company. Complete control in the hands of a single person: In One Person Company, the control and management is in the hands of a single person so quick decision-making and execution is done. This motivates to grow the company further. Minimum requirements for registration : A natural person who is an Indian citizen and resident in Aurangabad can incorporate One Person Company (Resident in Aurangabad means who has stayed in Aurangabad for a period of 182 days in the previous calendar year) Legal entities such as companies or LLP cannot incorporate an OPC. The minimum authorized capital is Rs.100000. A nominee must be appointed. Businesses involved in financial activities cannot be incorporated as OPC. One Person Company must be converted into a private company if the paid-up share capital exceeds Rs. 50 lakhs or turnover crosses Rs. 2 crores. Annual Compliances: At least one Board Meeting should be held in 6 months. The time gap between the board meetings should not exceed 90 days. A statutory Audit should be done by a Chartered Accountant. Statutory Registers and Minutes should be maintained properly. The annual return should be filed in Form MGT-7. The financial statements must be filed in Form AOC-4. Filing of an ITR every 30 September. Appointment of an Auditor. Annual filings to the Registrar of Companies.

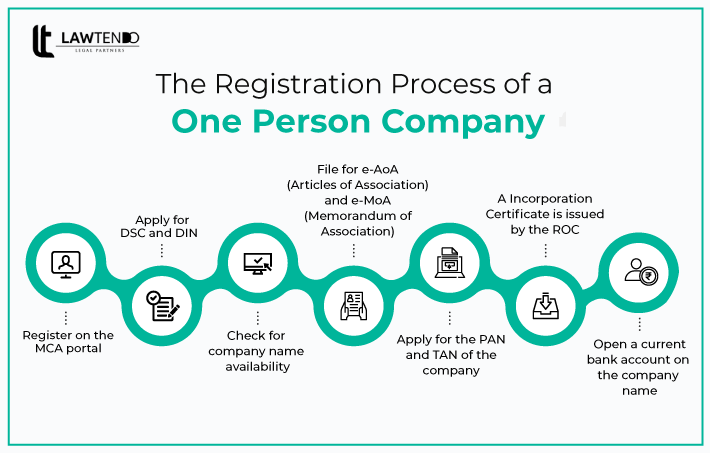

Steps To Obtain one person company registered IN AURANGABAD

- Apply For DSC

- Application To Obtain DIN

- Company’s Name Approval

- Re-Check All The Documents

- Submission Of Forms

- Issuance Of Certificate Of Incorporation By The Authorities

Digital Signature Certificate (DSC) is obtained by the director to sign all the online documents. It can be acquired from nearby agencies; the fees of obtaining DSC vary from agency to agency.

Once the Digital Signature Certificate (DSC) is made, the next step is to apply for the Director Identification Number (DIN) of the proposed Director in SPICe Form along with the details like the name and the address proof of the director. Form DIR-3 is the option available only for existing companies. It means from January 2018, the applicant need not file Form DIR-3 separately. Now DIN can be submitted within SPICe form for up to three directors.

Once you have acquired DSC and DIN, now decide the name of the company and get it approved by the Ministry of Corporate Affairs. Name of the company should be in the format of “ABD (OPC) Private Limited.”

Make sure all the documents are in the accurate format. Check whether the details of your PAN card matches with the details of your other proof such as address proof. In case of some spelling mistakes, get it corrected before the submission.

After uploading, Form 49A and 49B will be generated for the PAN and TAN generation of the Company which has to be uploaded to MCA after affixing the DSC of the proposed Director.

On verification, the Registrar of Companies (ROC) will issue a Certificate of Incorporation and we can commence our business.

Estimate Time REQUIRED FOR ONE PERSON COMPANY REGISTRATION

It usually takes 12-15 business days for the OPC Registration in Aurangabad.

Documents Required for ONE PERSON COMPANY REGISTRATION

Documents of directors/ shareholders:

Passport size photos

PAN card of all the promoters

Address proof ( any one of the following): telephone, gas electricity bill or Bank Statement

Identity proof (any one of the following): Passport, Voter ID, or Driving license

Documents for registered address:

Proof of premises (any one of the following): telephone, electricity or water bill

NOC from owner

Conveyance, lease deed or rent agreement along with rent receipts if any

Why Choose Lawtendo

Click here to know about One Person Company Registration In Aurangabad