BOOK A SERVICE

ONLINE SUCCESSION CERTIFICATE SERVICES OVERVIEW IN MADURAI

Do you also want to get a Succession Certificate in Madurai to get a share of the debts and securities of the deceased? The importance of a Succession Certificate in Madurai has been discussed in further detail. If you want to get one for yours, do connect with the team of legal experts at Lawtendo.

Succession Certificate in Madurai

The name of this certificate connotes that it is a Succession Certificate which has to be issued by the Civil Courts in case of the death of a deceased. The importance of a Succession Certificate comes into the picture when the deceased has died intestate i.e. dying without writing a Will. There are various reasons for which a Succession Certificate in Madurai is preferred which is also discussed in the next sections of this article.

What are the purported benefits of a Succession Certificate in Madurai?

There are various benefits that a Succession Certificate in Madurai provides. The important areas which are dealt with a Succession Certificate are:

- Identifying the Legal Heirs: The most important benefit connected to obtaining a Succession Certificate in Madurai is the identification of the legal heirs in a better and more efficient way.

Inheritance Rights: With the help of a Succession Certificate the rights of inheritance are granted after identifying the legal heir of the deceased in Madurai.

- Avoidance of disputes: With the help of a Succession Certificate in Madurai after identifying the legal heirs the rights of inheritance of that legal heir are identified thereby resulting in avoidance of the disputes.

This is how a Succession Certificate in Madurai benefits the legal heirs of the deceased in Madurai.

Who are the applicants to obtain a Succession Certificate in Madurai?

Even if they possess a legal heir certificate, family members are not obliged to file for a Succession Certificate unless they have the biggest stake in the disputed debt or security of the deceased. The following people may apply for a Succession Certificate in Madurai. These are listed in the following order:

- The deceased's legitimate heir

- The individual in possession of the Letter of Administration and

- The designated Executor of the Deceased's Estate.

This enables these individuals to be recognised as qualified applicants by the Indian District Courts when submitting an application for a Succession Certificate.

Relationship between the Succession Laws in Madurai and a Succession Certificate

The Succession Certificate procedure and all of its related components have beginnings and ends that are designated by the laws of succession. All succession-related events, occurrences, and certifications are predicated on succession rules, regardless of the type of succession—intellectual, legal, or planned. A "Success Certificate" is only accessible to the surviving legal heirs of the dead.

Thus, some of the statutes are the Hindu Succession Act, the Indian Succession Act, and Sharia law. The majority of India's population is religious, hence these are the main requirements that specify how a person might obtain a Succession Certificate in compliance with their specific legal and religious requirements.

Rights of the Holder of the Succession Certificate in Madurai

The primary rights that come with a Succession Certificate are enumerated in the sections of this article that are highlighted above. To assist you in getting one for yourself, you will require a law specialist in Madurai.

A resident of India who possesses a Succession Certificate is qualified to carry out particular tasks and obligations. The sequence in which they are listed is as follows:

- Succession: Purchasing the decedent's possessions and obligations is the main advantage for the bearer of the Succession Certificate. Eventually, the rentals or earnings from the deceased's belongings are given to them. They can then choose to sue the person who offended them.

- Asset Disposal: In addition, an asset's owner is always free to sell, lease, mortgage, or place a lien on it.

Hence, these are the rights entrusted onto the shoulders of the Succession Certificate holder in Madurai.

Movable Property and a Succession Certificate in Madurai

The most frequent use of succession certificates is to obtain movable property from the deceased, such as securities, bank accounts, mutual funds, fixed deposits, and so on, in situations when the deceased died intestate and left no will.

Before moving money from the deceased's accounts to the legal heir's account, banks in Madurai always need Succession Certificates as proof of the deceased's passing. This webpage provides more details regarding the specific steps required in Madurai to obtain a Succession Certificate.

Immovable Property and Succession Certificate in Madurai

Generally, a gift deed or other transfer can be consulted as a guide to determine real estate ownership. A Succession Certificate is necessary if the deceased had no will and the legitimate heir must prove they are entitled to the inheritance.

When someone dies without a will or intestate, a Succession Certificate is necessary. A Will is essentially a legally enforceable document that distributes a deceased person's belongings and names the beneficiaries. The true heir in real estate transactions is typically identified by consulting a gift deed or other transfer documents.

What is the validity of a Succession Certificate issued in Madurai and overseas?

A Succession Certificate from an Indian government-affiliated organisation that is received outside the nation is just as legitimate as one that is obtained within. The bearer of this Succession Certificate is also entitled to the privileges that Indian Civil Courts are mandated to provide.

Since national succession legislation governs it, the Succession Certificate is recognised throughout the nation. A person may also be qualified for benefits in Guwahati if they possess a Succession Certificate issued in Faridabad. This is accurate because a Succession Certificate frequently contains the holder's name, securities, obligations, and related rights.

Implications of Stamp Duty on a Succession Certificate in Madurai

Stamp duty on the issuance of a Succession Certificate in Madurai is often two to three percent of the property's value; however, there isn't a precise way to calculate this amount at the moment. The only factor used to determine the amount of Stamp Duty that must be paid on a Succession Certificate is the debt or security worth of the deceased.

Obtaining a Succession Certificate in Madurai

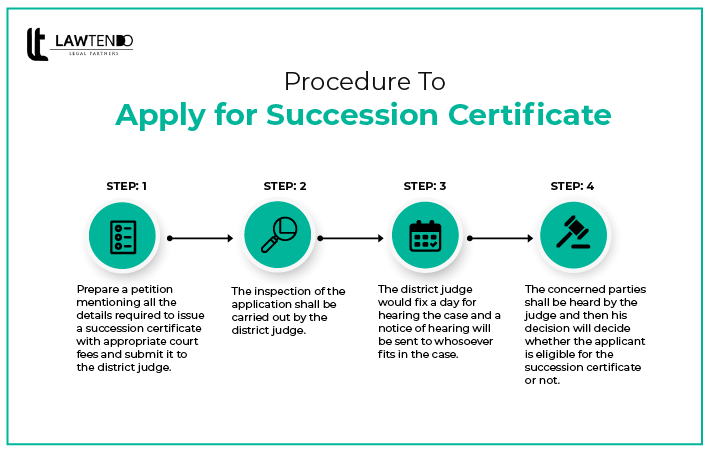

To obtain a Succession Certificate in Madurai, the following procedures must be fulfilled:

- Presentation of Application: As stated above, in order to get a Succession Certificate in Madurai, the application and any supporting evidence must be delivered to the district court having jurisdiction over the pertinent geographic or fiscal region.

- Notice Issue: The District Judge supervising the legal heir's application notifies the other heirs about the death and extends an invitation to submit a claim regarding the debts and securities. The notice is published in the local newspaper. This is being done to ensure that the legal heir's claim in their petition is true and that granting it won't have a detrimental effect on any other deceased lawful heirs.

- Hearing of the legal heirs: Within 45 days of the news announcement, the District Judge will review any claims submitted by the surviving legal heirs of the deceased person.

- Certificate Award: In the event that no other rightful heir brings a lawsuit, the petitioner receives a Succession Certificate from the court. The court's decision-making process will be guided by the values of justice, conscience, and fairness in the event that another rightful heir files a claim.

- Submission of Bond: Upon issuing of the Succession Certificate, the judge directed the holder to execute a bond with one or more sureties. This was done to guarantee that the bond would pay for any losses resulting from certificate misuse.

Prior to starting the process of acquiring a Succession Certificate in Madurai, it is advisable to speak with a legal expert to make sure everything goes as planned and you don't end up suffering. Furthermore, this is to make it simple for you to obtain the Succession Certificate.

Reasons put forth for rescinding a Succession Certificate in Madurai

The principal causes for a Succession Certificate to be cancelled in Madurai are as follows:

- An alternative line of action might be counterproductive for the court cases that resulted in the invalidity or inadequacy of the Succession Certificate.

- It has fulfilled the purpose for which the Succession Certificate was intended.

- The legal successor got the Succession Certificate via dishonest, fraudulent, or deceptive means.

As a result, the supposed legal successor's Succession Certificate has been revoked by the legitimate legal heir in Kolhapur using these grounds. The procedure to revoke the Succession Certificate in Madurai that has already been issued must be followed by a legitimate legal successor; this procedure is explained below.

The process for cancelling a Succession Certificate in Madurai

The previously awarded or recorded Succession Certificate may be revoked for any of the previously listed reasons, or for any other cause the court deems suitable. A qualified heir who may be entitled to the decedent's property could start the cancellation process. The legal heir in Madurai needs to take the following action in order to cancel the Succession Certificate.

- Petition for Revocation: In order to start the revocation procedure of a Succession Certificate in Madurai, you need to formally oppose the Succession Certificate by filing a court petition, citing any of the revocation grounds listed above.

- Judge's opinion: The court considers the petitioner's claims and arguments for their inheritance after carefully assessing the respondent's objection.

- Revocation of the Succession Document: After carefully examining the matter, the court will grant the respondent a new Succession Certificate if it determines that the respondent is the original, legal successor of the dead. The court will immediately invalidate the previously issued certificate if it turns out that the petitioner obtained the Succession Certificate through unfair or dishonest means.

Thus, this is the process of revocation of a Succession Certificate in Madurai.

The Differentiation between a Legal Heir Certificate and a Succession Certificate in Madurai

Justification for distinction | Legal Heir Certificate | Succession Certificate |

Classification of the property | It is applicable to immovable property | It is applicable to movable property |

Issuance Authority | It is issued by the local authorities | It is issued by the Courts |

Steps To Obtain a succession certificate IN MADURAI

- Preparation of the documents

- Drafting of Petition

- Submission and Court Visit

- Grant of Certificate

You must collect the documents to suggest the asset or debt belonged to the deceased and the death certificate of the deceased, their identity card, ration card of all legal heirs and any other documents as suggested by the lawyer.

A petition for succession certificate includes details such as the time of death of the deceased, residence or details of properties of the deceased at the time of death, details of family or other near relatives and others. It is best advised to find legal help in order to create the petition, because if anything goes amiss, it may have serious consequences.

The petition will be moved in a court of competent jurisdiction and the date of the visit shall be intimated to you by the lawyer.

After hearing all parties, the Judge shall decide the right of the petitioner to be granted the succession certificate.

Estimate Time REQUIRED FOR ONLINE SUCCESSION CERTIFICATE

The complete procedure of obtaining a Succession Certificate will take 30-45 days depending on the court.

Documents Required for SUCCESSION CERTIFICATE ONLINE IN MADURAI

To get a Succession Certificate in India, you have to submit to the surviving spouse the following documents as proof of your legal heirship. And that's exactly what they are:

- The Identity of the deceased, the place and time of death, and the executor's name.

- Wills and, Letters of Administration, if applicable

- The Death Certificate for the deceased

- A title declaration or proof of ownership (such as an affidavit) proving the designated successor is the deceased person's original, rightful heir.

As a result, the extensive list of documents needed to apply for an India Succession Certificate is shown below.

Why Choose Lawtendo

Click here to know about Succession Certificate Online In Adilabad