Govinda Kohli

Lawtendo helped me in registering my company in such a great professional manner great team

Section 8 companies are Non Profit Organisations that work for nonprofit objectives such as the promotion of commerce, arts, science, sports, education, research, social welfare, charity, protection of the environment, sports, etc. The process of incorporation of section 8 companies is the same as that of other private and public companies with an additional requirement of a license from the Central Government. The main purpose of Section 8 Companies is to promote nonprofit objectives. The profits or income of these companies, if any, are applied to the objectives of the company and are not distributed to the shareholders as dividends. Benefits: Tax Exemptions: Section 8 Companies can avail benefits under section 80G of the Income Tax Act, 1961. They are also required to pay less stamp duty as compared to other organizations. There is also an add-on benefit given to the donors of the company for Tax Deduction. Share Capital: Like other companies( private, public, or one person) section 8 registered companies are not required to keep minimum share capital. They are funded by subscriptions and donations. Use of Title: They are not supposed to include the terms” private limited” or “limited” as a suffix in the name of the company. Annual General Meetings: They can conduct general meetings under a shorter period of Notice i.e within 14 days instead of 21 days for limited companies. Stamp Duty: Lesser amount of stamp duty is payable as compared to other organizations/ companies. Prerequisites to the Registration Process: Obtain DSC ( Digital Signature Certificate): Digital signatures of the proposed directors of the company are required as the forms for the registration process are filed online and should be digitally signed. Digital Signature Certificates are issued by the government-recognized certifying agencies. The cost of DSC varies from agency to agency. You must obtain either a class 2 or a class 3 category. Underclass 2 category, the identity of a person is verified against a pre-verified database, under the class 3 category, the person needs to present himself before registering authority to prove his/ her identity. Apply for Director Identification Number (DIN): The proposed directors have to apply for DIN. Fill the Form DIR-3 to make an application for allotment of DIN. You have to attach the scanned copy of the necessary documents such as a self-attested copy of PAN, Identity and Address Proof of directors along with the form and submit it online on the MCA Portal. The form must be attested by a practicing professional who can be a CA/ CS/ Cost Accountant. Forms required for Registration: INC 1- This form is for Name Approval of the Organisation. This form is filed for reservation of the name of the proposed company. Before quoting the name in the form it is recommended to access the free name search facility of existing companies available on the MCA Portal. You can make up to 6 choices of names in order of preferences in the form. INC 7- This form is for Application for Incorporation of Company. The following documents must be attached with this form: A Memorandum of Association (MoA) and AOA (Articles of Association) of the company which is duly signed by all the subscribers. An Affidavit from each of the subscribers and first directors in Form INC 9, stating that they are not guilty of any offence or misfeasance. There must be a declaration in Form INC- 8 that all the requirements of the Companies Act have been complied with. Correspondence address until the registered office is official. All the Subscribers to MOA and First directors of the Company have to submit Address and Identity proofs. INC 12- This form is filed for grant of license to operate as section 8 Company. The following attachments are to be done along with the Form: A draft copy of the MOA and AOA in the prescribed format as in form INC-13 INC -15 form is filed for the declaration by each subscriber to MOA that the draft MOA and AOA have complied with the provisions of Section 8 Estimated Statement of Income and Expenditure for the next three years. A list of the proposed directors and promoters of the company. INC 14- This form is filed as a Declaration from a practicing Chartered Accountant. INC 16- This form is filed for grant of license to incorporate as section 8 Company. INC 22- This form is filed for providing notice of the address of the company’s registered office. Form INC- 7 can be filed along with this form , or once 30 days are completed after the Incorporation of the Company. DIR 2- This form is filed stating the consent of the Directors. DIR 3- This form is filed for making the Application to ROC to get DIN. DIR 12-This form is filed for the appointment of the directors of the company. The form needs to be filed within 30 days from the date of the appointment of the directors. Minimum requirements of Section 8 Companies: Shareholders: 2 Directors: Minimum of 2 directors are required if the section 8 company is to be incorporated as a Private Company and 3 directors if incorporated as a Public Company from which at least one director shall be Resident in Allahabad. Share Capital: There is no requirement of Minimum Capital. Income Tax PAN is a mandatory requirement for Indian Nationals. Any one of the Identity Proof (Voter ID, Aadhaar Card, Driving License, Passport); Passport is mandatory as an identity proof in case of foreign nationals. Proof of Residence from among the following (Electricity Bill, Telephone Bill, Mobile Bill, Bank Statement) Registered Office Address Proof (Rent Agreement along with latest rent receipt and copy of latest utility bill in name of the landlord and a no-objection certificate from the owner of the premises, in case the premises are rented). If the premises are owned by a Director and Promoters any document such as Sale Deed or House Tax Receipt along with no objection certificate.

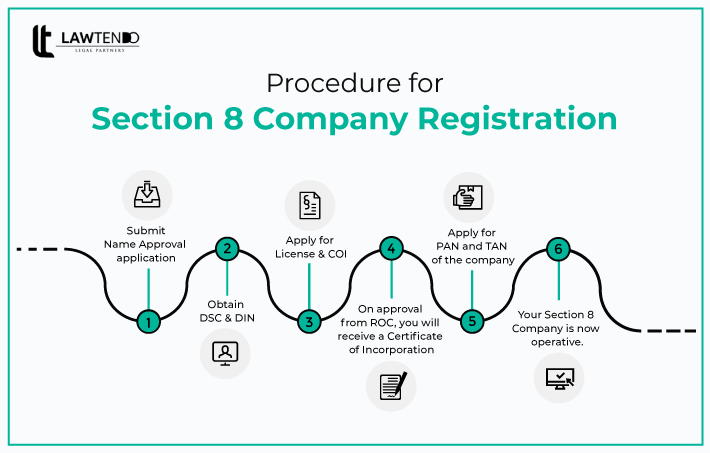

Applications would be filed with the ROC to acquire DIN and DSC for the Directors. Duly signed. You need to apply for DSC, first. Once it has been received, Form DIR-3 is to be filed with the ROC to obtain their DIN. A passport-sized photograph, attested ID Proof and Address proof of the Director are to be attached to these applications.

Suggest your preferences after conducting Company Name Search. After selecting the 3 options, apply for a unique name for your Company. Name availability has to be seen in the “Reserve Unique Name” or RUN facility. 2 names is to be proposed, initially, in Form INC-1. If rejected 1 resubmission is allowed. Both times in separate formats.

Apply for the Section 8 License with the Central Govt. The format to be used is Form INC-12. It is to be filed with MoA in Form INC-13. AoA, Declaration of CA/CS/CWA in Form INC-14, Declaration by Directors in Form INC-15, Name Approval Letter, and a 3-year estimate of future income & expenses. And apply for the COI. COI or Certificate of Incorporation is proof that the company has been created.

As soon as all the processes have been completed and your Section 8 Company has been registered, then apply for your PAN and TAN. It is filed with Forms INC-7, 8, 10, 9, 22, DIR-2, and 12 with the ROC, along with the required documents.

The applicable fee, vary from company to company, depending on the structure and other factors.incorporation of a Section 8 Company takes around 20-30 days. The time taken for registration will depend on the submission of relevant documents by the client and the speed of Government Approvals. To ensure speedy registration, please choose a unique name for your Company and ensure you have all the required documents before starting the registration process.

Documents for Directors or Shareholders:

Passport size colour photograph

PAN Card of all the Promoters

Address Proof from among the following: Telephone, Gas, Electricity Bill or Bank Statement

Identity Proof: Passport, Voter ID, or Driving License

Documents for Registered Address:

Proof of Premises: Telephone Electricity or Water Bill

NOC from Owner (According to NOC Format)

Click here to know about Section 8 Company Registration In Adilabad